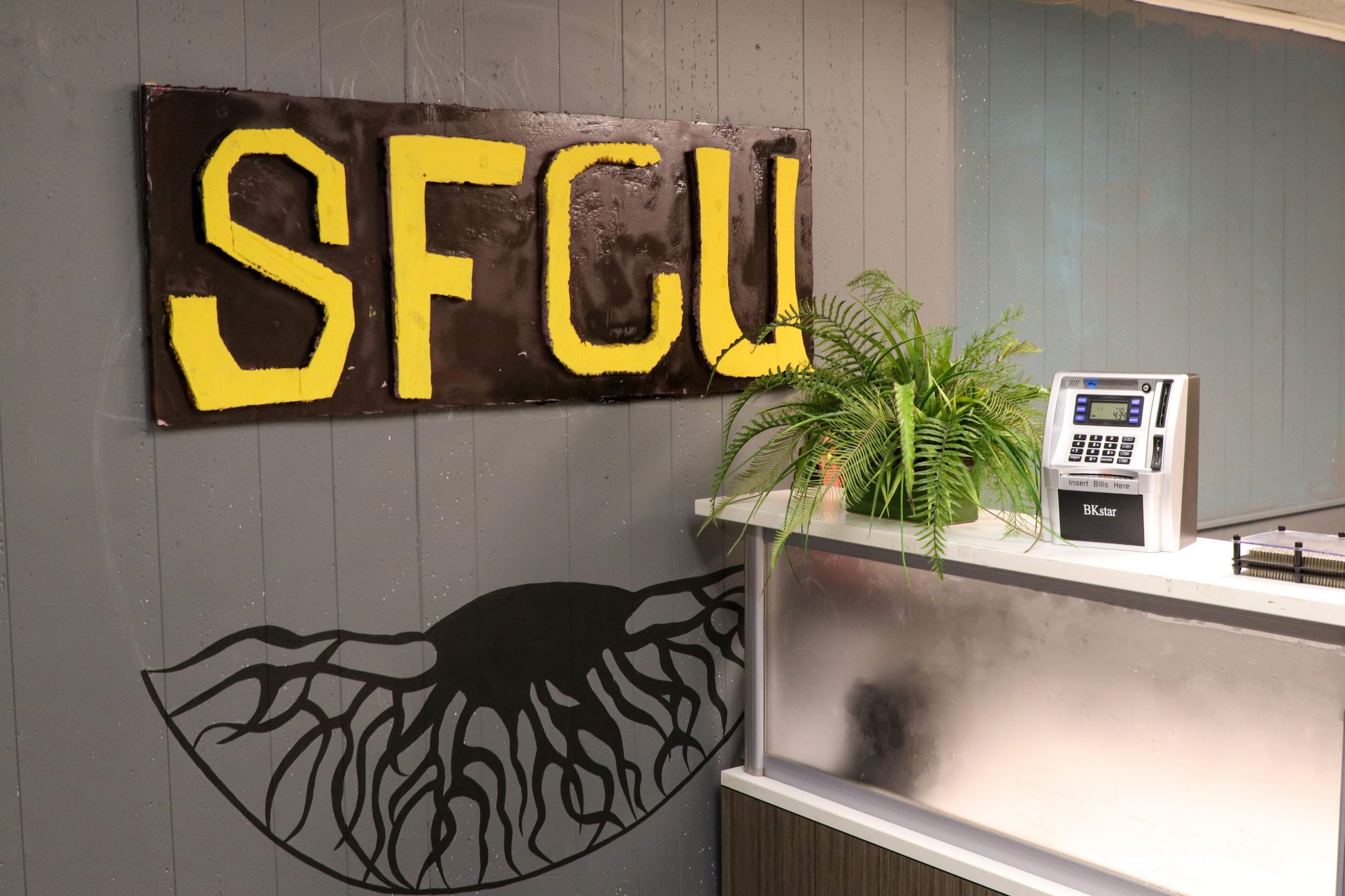

Saratoga Family Residence is fostering the next generation of entrepreneurs in its Afterschool program. Through the Saratoga Financial Credit Union—which operates with “Saratoga Bucks” as its currency—and the Youth Entrepreneurs Pop-Up Shop—a temporary store front in the Recreation area—students learn real-world financial concepts and gain hands-on experience with running a business.

“The Credit Union was developed to teach the kids financial literacy and to help them understand different things in terms of cost and reward,” said Director of Afterschool and Recreation Michael Chapman.

The Afterschool kids were each initially given 50 Saratoga Bucks—or “Sag Bucks”—to open a bank account at the credit union and are entered in a weekly raffle to win more of this currency to add to their savings. They can also earn Sag Bucks through random acts of kindness and other actions that demonstrate leadership and class participation. If they save responsibly, they can eventually buy items from a shop at the credit union.

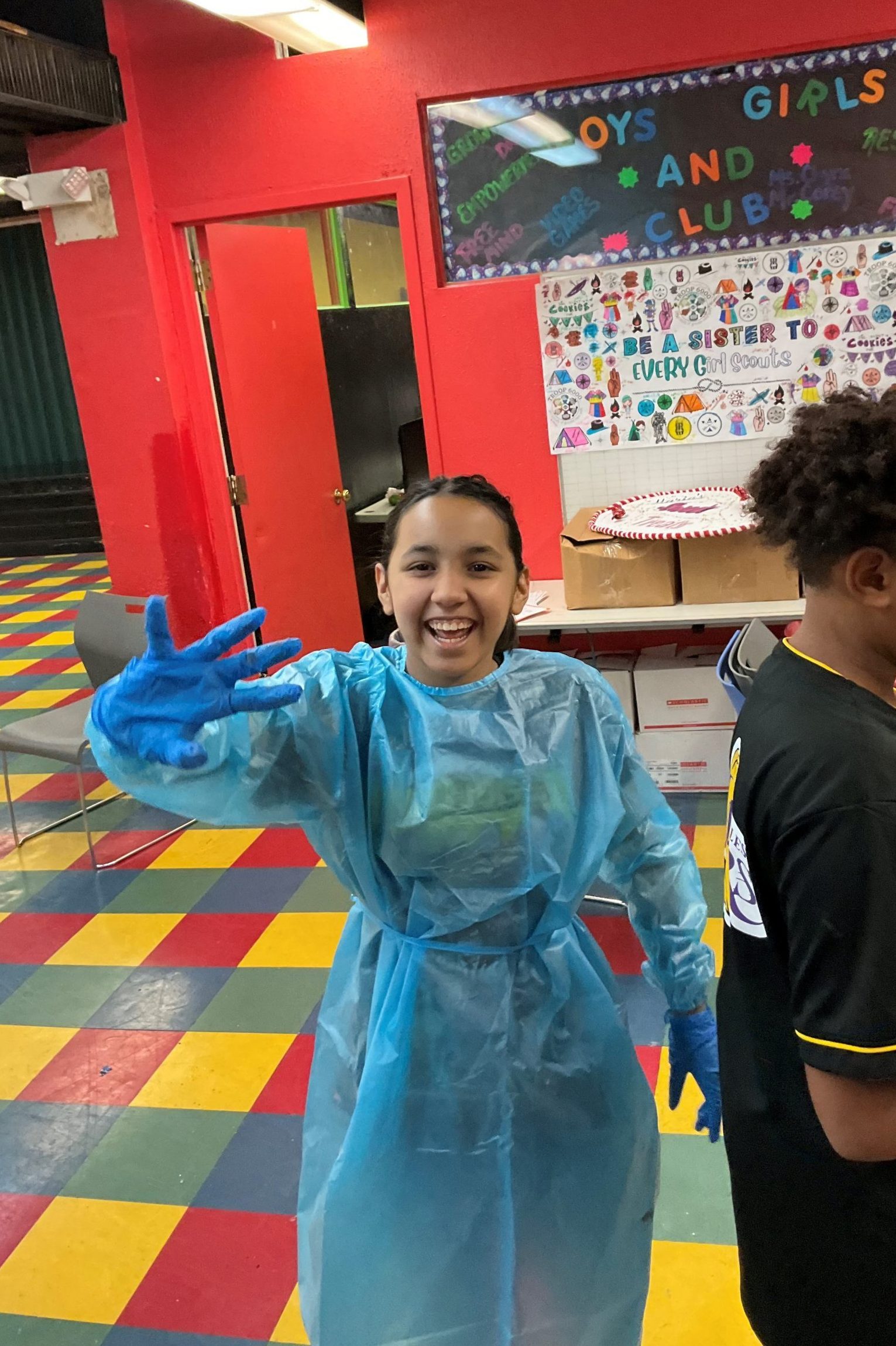

Budding businessmen and women interested in earning an additional income work with Recreation Coordinator Beverly George, who runs the Youth Entrepreneurship Program, to bring their visions to life—from presenting a business plan to running their very own pop-up shops. Businesses include jewelry shops, a t-shirt store, and a candy shop.

One student, Quesia, who is also the bank manager, is planning for the opening of a pop-up shop which will sell handmade earrings, bracelets, and rings.

“I am starting a bracelet business with one of my best friends, [London]. I have been thinking about putting up a big sign—something eye-catching that you can’t miss,” said Quesia. “I always wanted to own a small business. I like the idea of not working for anybody.”

Through the Youth Entrepreneurship Program, students are exposed to and learn transferable life skills such as innovation, responsibility, teamwork, and time management skills.

“We want to teach them about leadership skills and business concepts, such as product development and marketing. I want to [help them] find something that they love to do,” said Beverly.

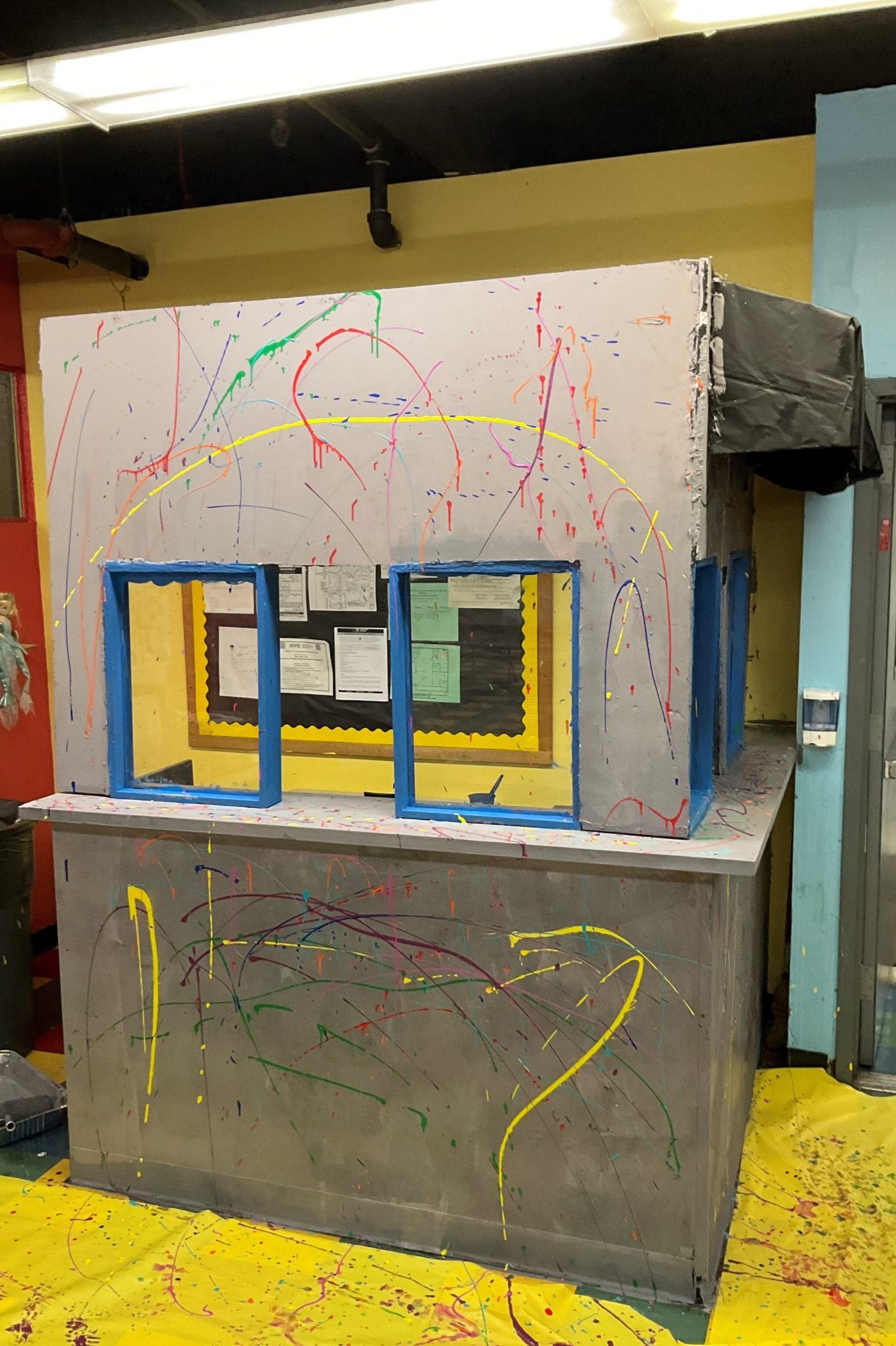

There are currently 15 kids—four teams—involved in the Youth Pop-Up Shop program. Each team will present a business plan, complete a training session on business and customer service, and sign a mock lease with the credit union to “rent” the pop-up shop space for a two-week period—learning about banking and loans along the way. During their lease, the kids transform the store front space to fit their product, develop marketing techniques, and hire staff to fulfill various roles at the store.

“They have a lot of fun just [developing] different ideas. They come up with what they want to sell, the pricing, and how long they are going to do it,” said Beverly.

“Right now, they are young, but after [they graduate], they may want to become business owners.”